POSTED ON 13 MAY 2025

READING TIME: 5 MINUTES

Aggregators and connectivity marketplaces - a gamechanger for Europe’s fibre market

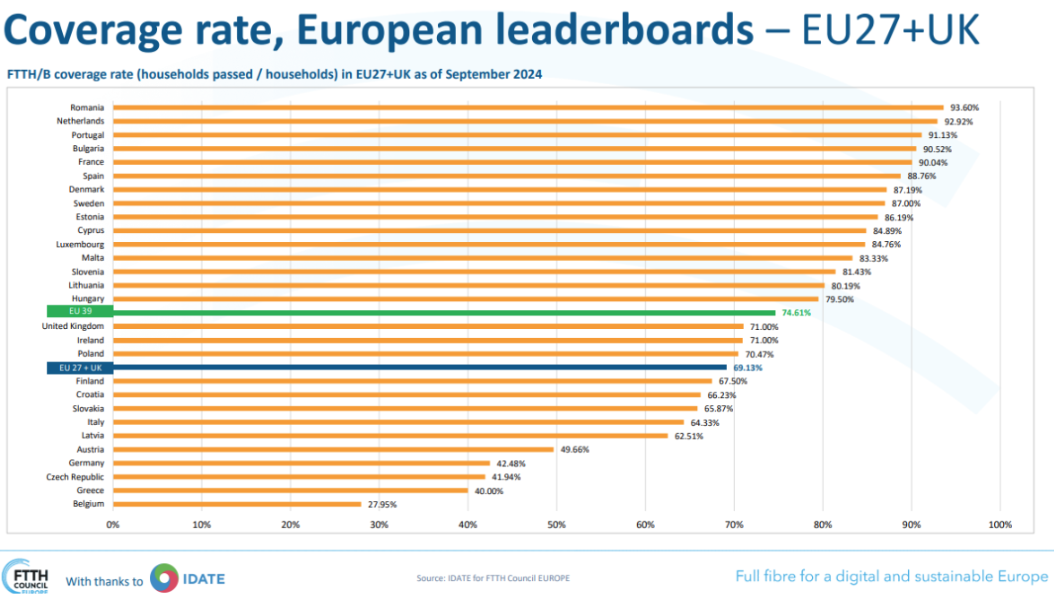

Europe’s Gigabit revolution has delivered a massive rollout of fibre-to-the-premises (FTTP) infrastructure. The initial investment rush created a fast start during the years of cheap money, with countries such as Spain, France and Sweden setting the pace in terms of the % of homes passed and connected.

But as money supply and valuations reversed course around 2022, the early investment thesis turned on its head, moving from a new-frontier-land-grab to focus on more challenging targets such as positive Ebitda and cash flow. This has resulted in accelerated industry consolidation in the form of M&A, particularly in the UK which had attracted over 100 new Altnets since the initial rush.

It has also resulted in Altnets reviewing their business models, as the founders and early investors seek to protect their positions and avoid downround consolidation. While there are many variables and strategies, the most basic question has been whether to go for a wholesale only, retail only, or a vertically integrated operation. After all, building a regional network with an enterprise sales operation is a very different proposition to scaling a B2C retail brand [more on this in a later blog post].

Open Access Wholesale Network Aggregation

An alternative option for Altnets to a downround consolidation is now rapidly emerging in the form of open access wholesale network aggregation, which also presents a scaling opportunity for ambitious ISPs.

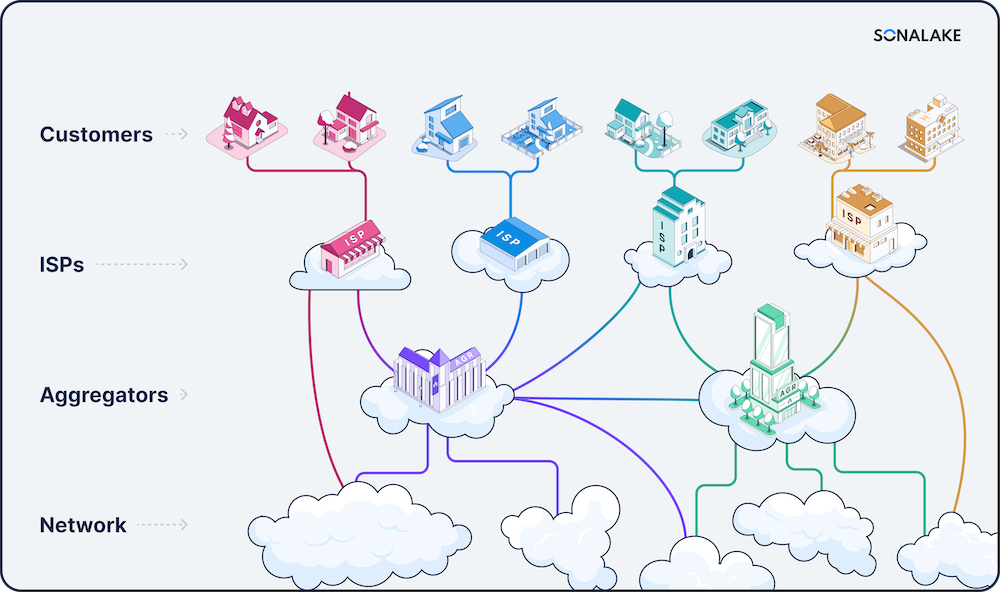

In simple terms, Aggregators integrate with multiple underlying wholesale networks, making their services accessible to ISPs through a standard northbound interface. They can thus be thought of as connectivity marketplaces, reducing the technical, operational, commercial and governance friction in interconnecting ISPs with both Incumbent networks and Altnets.

In our view, this network aggregation model creates supply chain efficiency. It builds a competitive open access environment that will maximise the benefits of national investments in fibre infrastructure.

At one level, it removes heavy technical barriers to give ISPs access to a super range of wholesale services on a national basis. At another level, it offers Altnets a channel of scale to wholesale their network services with a much reduced opex. In short, ISP’s, Aggregators and Wholesale networks can all focus on doing what they do best, resulting in better product choice and service quality for the consumer.

Market Adoption

In the UK, Aggregators are currently making serious investments. The latest major investment saw AllPoints Fibre Networks (APFN) launch its aquila platform, following a major investment by Fern Trading, managed by Octopus Group (majority owner of Octopus Energy). APFN is promising a new era for wholesale connectivity, combining its low latency national backbone network with a low friction customer experience, enabled by deep automation. In 2024, PXC spun out of TalkTalk to offer its national network and wholesale services to ISPs, with a playbook for additional Altnets to plug their networks into its service. On May 7, 2025, Zen Internet announced its Fibre Hub service offering Openreach, Cityfibre, Trooli and Freedom Fibre as access network partners.

Broadband network aggregation has previously been adopted in other markets, from Sweden and Ireland to the US, albeit in a more fragmented and less comprehensive manner. However these UK aggregators are bringing the model to a new level, with other similar players establishing services in Germany, Denmark and across the continent.

Aggregation & Standards

At the ISP Summit in Westminster on the 8th of May, Sonalake’s Niall Halpenny hosted a panel discussion on Aggregation and related standards. Niall was joined on stage by Ronan Kelly (CTO at APFN), Katie Crellin (Head of Regulation at PXC), Max Fernando (Head of Regulation at Glide) and Reinier Kramer (COO at Genexis), with additional contribution from Andy Sayle of Zen Internet in the audience, so it was a strong representation from UK wholesale aggregators.

The panel discussed the concept of aggregation as an alternative to consolidation and its associated challenges. Echoing the earlier investor session, they highlighted the challenges of consolidating Altnets, emphasizing the integration of disparate IT systems (BSS/OSS) as being a hugely complex and costly aspect. The fact that most of these systems were custom developed at varying levels of competence and against disparate, or no particular standards, exasperates the issue.

Katie underlined the trend by quoting a recent survey where 56% of Altnets said they want to work with an aggregator as a preferred route to sales with manageable opex.

Niall also described the open access and wholesale standards work ongoing within FTTH Council Europe and within individual markets, such as INCA in the UK and Breko in Germany, and panel members described their own interactions with standards and how the principles of open access are aligned with success in network aggregation.

In summary, wholesale network aggregation and connectivity marketplaces are here to stay! They are going to evolve and it's going to be very interesting to see how their platforms and services develop. We believe that they will also attract large retail brands to enter the ISP market.

We look forward to the launch of APFN’s aquila platform this week. We have a vested interest as APFN’s software platform partner and will report further as aquila is unveiled.