Case Studies

The best way to get to know us

Browse through our work and see examples of our customer engagements and projects. Explore how we helped customers accelerate their businesses.

The mobile travel technology partner needed an analytics product to complement its core products, and provide detailed analysis of user interactions and behaviors.

data sciencetravel tech

We helped Ryanair to advance its digital infrastructure and services through a Team Augmentation collaboration out of our Poznan engineering centre.

travel tech

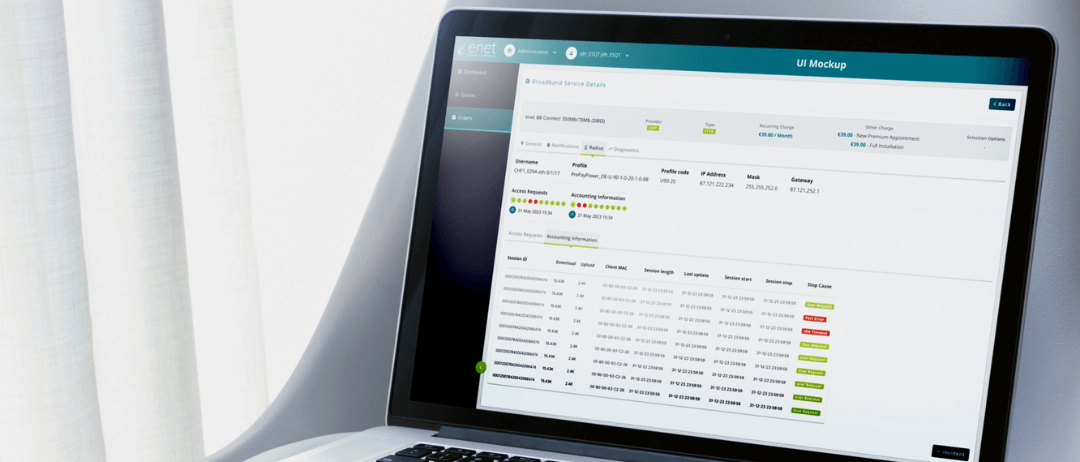

We delivered an automated self service CPQ engine to help Enet's business customers quickly generate accurate quotes and continue on to order fulfilment of the selected products.

telecomfttx

We supported NBI’s unprecedented high-speed fibre rollout by designing and building the OE architecture needed to enable their customer journeys and interactions.

telecomfttx

We helped the New York-based cybersecurity startup to rapidly scale its engineering capacity, which facilitated its expansion into Central and Eastern Europe.

security

As part of an aggressive development roadmap, the privacy-enhancing analytics platform needed help to rapidly scale its engineering capacity and get its products to market.

data privacy

Yahoo! needed a software services partner that could augment its core engineering team capacity and integrate seamlessly on a flexible and cost efficient basis.

ad tech

The optometry software developer needed to develop a next generation solution suite with a revamped front end, increased capacity and an updated UX design.

medtech

With the increase in data volume and the introduction of 5G, Vodafone challenged us to provide an automated way to predict cell congestion issues in their network.

telecom5g

We were able to provide real-time monitoring, data analysis and insights for Three’s network along with a tailored range of wallboards and dashboards.

telecom

We helped the financial software provider establish a development centre in Eastern Europe with a focus on maintaining existing engineering and quality standards.

fintech product development

The sports-tech company needed a secure system that allowed it to store, interpret and visualise athletes’ biometric data so that its business could go global.

analytics

This oil and gas exploration company needed a bespoke geo-physical data management system to store, catalogue and access datasets on seismic and non-seismic surveys.

data analytics

We delivered a scalable aggregation platform for the wholesale fibre and wireless operator that allowed it to deliver new services to multiple retail service providers.

telecomfttx

The network service provider needed real-time visibility of their network health to support ambitious plans to introduce superfast broadband on an Atlantic Island.

telecom

Ericsson asked us to re-engineer a telecommunications network test and measurement solution that could meet client requirements across different jurisdictions.

telecom

AdaptiveMobile Security’s engineering team was seeking a software services partner to add capacity flexibility into its agile development process.

telecomsecurity

We developed an intuitive, user-friendly interface to securely manage subscriber information and provide customised access for various teams within the organisation.

telecom 4g